Although Natural Hair is the focus of this blog, it is absolutely clear that within the context of whatever we do, we must be mindful of our day to day concerns in terms of finances. So, I have written previously about how wearing your hair in natural styles saves you money, because by doing so, there is no need for Salons, you can make your own product from natural sources or simply be very selective about what you buy and if you choose to, you can be very low maintenance with your hair, opting for a more free style approach.

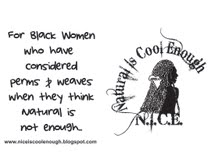

Since, I interface with college students on a daily basis, many struggling with hair issues and trying to determine whether Natural Is Cool Enough or if they should opt for more mainstream approaches such as weave, perms, etc., I decided to discuss, briefly, another topic that is very important to them. A N.I.C.E. group was started on campus to discuss natural hair. So, this is an important topic in terms of college students. But, inevitably, a more significant topic, particularly for those who are about to graduate from college, is student loans. A big question that is frequently asked of me follows: "is there any way for my student loans to be forgiven?" So, to address this matter, I have written a new booklet. Yes, it is a deviation from the Natural Hair Topic, but it is all within the context of managing your life in a calm, nurturing way as much as possible.

So, I am taking a N.I.C.E pause to introduce you to my newest work: Forgiveness For Your Student Loans: A Survival Guide, Part I. Check it out at the link below!

http://www.amazon.com/Forgiveness-Your-Student-Loans-ebook/dp/B00CO8CR2A/ref=sr_1_3?s=books&ie=UTF8&qid=1368017628&sr=1-3&keywords=Forgiveness+for+your+student+loans

This booklet is for every person who has student loans. It will serve as an insightful mini-guide as to how one can begin to forgive himself/herself for taking out numerous and costly student loans and then, next steps to handle and manage this debt to avoid default. The goal is to enable each person, after reading the words contained within, to feel good/better about themselves for making what they may feel retrospectively, was a big financial mistake and to simultaneously understand the process of taking control of their student loans in a dignified and empowered manner. This book is the first in a series and it is a quick, clear and precise read. It discusses student loans with sensitivity and provides guidance that every person needs that has taken out a student loan.

Since, I interface with college students on a daily basis, many struggling with hair issues and trying to determine whether Natural Is Cool Enough or if they should opt for more mainstream approaches such as weave, perms, etc., I decided to discuss, briefly, another topic that is very important to them. A N.I.C.E. group was started on campus to discuss natural hair. So, this is an important topic in terms of college students. But, inevitably, a more significant topic, particularly for those who are about to graduate from college, is student loans. A big question that is frequently asked of me follows: "is there any way for my student loans to be forgiven?" So, to address this matter, I have written a new booklet. Yes, it is a deviation from the Natural Hair Topic, but it is all within the context of managing your life in a calm, nurturing way as much as possible.

So, I am taking a N.I.C.E pause to introduce you to my newest work: Forgiveness For Your Student Loans: A Survival Guide, Part I. Check it out at the link below!

http://www.amazon.com/Forgiveness-Your-Student-Loans-ebook/dp/B00CO8CR2A/ref=sr_1_3?s=books&ie=UTF8&qid=1368017628&sr=1-3&keywords=Forgiveness+for+your+student+loans

This booklet is for every person who has student loans. It will serve as an insightful mini-guide as to how one can begin to forgive himself/herself for taking out numerous and costly student loans and then, next steps to handle and manage this debt to avoid default. The goal is to enable each person, after reading the words contained within, to feel good/better about themselves for making what they may feel retrospectively, was a big financial mistake and to simultaneously understand the process of taking control of their student loans in a dignified and empowered manner. This book is the first in a series and it is a quick, clear and precise read. It discusses student loans with sensitivity and provides guidance that every person needs that has taken out a student loan.

No comments:

Post a Comment