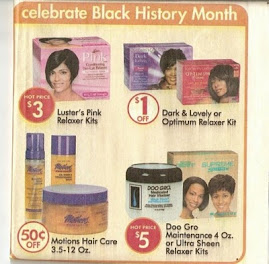

Let me begin by asking some questions. How much money do you spend on your hair? How often do you go to the salon/beauty parlor? How much do you pay to get your hair permed or touched up? How much do you pay for natural hair products? How much money do you spend on weave? Truly ask yourself these questions and perhaps, if you have time, sit down and add up the costs. Are the figures reasonable? As the author Iyanla Vanzant says, "tell yourself the truth about yourself." Look in the mirror and tell yourself the truth about how much money you spend on your hair whether your style is natural or not.

The reason I am bringing this up is because I just finished writing a new book. Actually it is the second of a series and is entitled Forgiveness for Your Student Loans, Part II: The Information You Need to Avoid Default! I wrote this book because this nation has over a trillion dollars in student loan debt. Students are paying or will be paying as graduates, over 6% interest on these loans and the debt is steadily piling up for most people who are pursuing higher education. It's an unfortunate situation but perhaps, an investment in yourself. Jobs are tight and you may or may not be able to find a job in the field in which you studied after you graduate but you will be educated, if you take the matter of your college experience, in the classroom, seriously. So, because some are unable to pay their student loan debt, for various reasons, I wrote books about this to try to provide important and useful information because student loan default is a serious financial problem for many. Why not avoid it, if you can? To acquire my new book, here is the site: http://www.amazon.com/Forgiveness-Your-Student-Loans-Part-ebook/dp/B00HNF3XWC/ref=sr_1_4?s=books&ie=UTF8&qid=1388776071&sr=1-4&keywords=forgiveness+for+your+student+loan

The book is in kindle format so if yo don't have a kindle, you can go to this site and download the free kindle app: http://www.amazon.com/gp/feature.html?docId=1000493771 The app can be downloaded to your smart phone, ipad, iphone, Windows 8 PC or tablet, Blackberry or Windows Phone.

I share this book with you because if you are a student taking out loans or a graduate of a college/university and have loans as a result, the above information may be useful to you. I bring it up in the context of getting our act together, in this new year, in regard to finances and perhaps spending less on our hair, as an immediate step. Personally, I believe it is cheaper to maintain your hair naturally. Literally, all that is needed is to wash your hair and take care of it yourself, which eliminates the cost of anyone else being involved. So what do you need? First let's begin with product. For some individuals, within the context of deciding to go natural, a need seems to arise to spend significant amounts of money on the purchase of hair products. Why? Truly, all that is needed is a good, thick, creamy shampoo and conditioner (if you can get them both in the same bottle, that is particularly great) and a good moisturizer. If you do not have locks, you need a good comb and whether you have locks or not, a good brush. That's truly it! There is not even a need for a blow dryer, which is very damaging to your hair and runs up your electricity bill!

Personally, I have reduced the costs in regard to taking care of my hair so significantly that I am extremely proud about it. There is very little money made by anyone in regard to my hair. All of the money that would be used to line someone's pockets in the billion dollar hair product industry is saved for me. All of that money and time that I would use to go sit in a chair for someone to do to my hair, what I can do for myself, is saved for me. I wash, condition, moisturize, twist and brush my own hair and have been doing so for over 20 years. I did go a little crazy with product when I decided to start my locks 22 years ago, and prior to that I spent lots of money getting my hair braided until I learned how to braid my own hair, including adding extensions and I don't even want to think about how much it was costing me when I was getting a perm. I've never had a weave, so luckily I was saved from that expense and time consuming endeavor while others would have made a lot of money off of me just so I could wear somebody else's hair that grew out of their scalp. As mentioned above, even when I braided my own hair, adding extensions, I lost way too much of my time and money for the purchase of the hair. So, I decided to stop that! Locks require me taking care of my own hair as it grows out of my scalp and it grows very, very long. Why would I need extensions, synthetic or otherwise? These were very personal decisions for me but it was when I came to these conclusions, in terms of my hair, that I realized that I was conscious and awake and this spread rapidly to many aspects of my life, financially and otherwise.

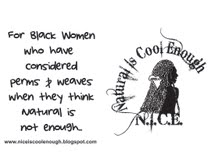

Ultimately, in this New Year, perhaps taking a moment to consider where we are spending money unnecessarily and taking charge of situations that can truly mess us up financially, like student loans, is a great place to start. Natural hair is so absolutely beautiful. There is no doubt about it. Styling it on your own and stepping out looking beautifully natural is a gift that you can give to yourself. All of the money you save can be used to travel or pay for portions of your education, reducing your need for loans or for anything else that you deem worthy of your money that benefits you. I have chosen these two topics, natural hair and student loans to focus on, as money saving/financial management considerations for the new year. I suggest that you start with your hair and work your way down to your feet and look all around you in terms of everything you are experiencing and decide what you may want to reconsider, in terms of how you spend your money, and how you manage your finances. In 2014, perhaps debt no more, is the way to go. If you ARE in debt, how can you acquire the knowledge to make it less stressful and so you can handle it in an empowered manner? The bottom line is that being natural, in terms of your hair, and taking care of that aspect of your life, financially, is a starting point to opening your consciousness about what matters to you. As you look at yourself in the mirror, in the year 2014, will it be better for you financially if you embraced your natural hair and decided Natural IS Cool Enough and took charge of managing your own hair? That would be and is definitely N.I.C.E.!

The reason I am bringing this up is because I just finished writing a new book. Actually it is the second of a series and is entitled Forgiveness for Your Student Loans, Part II: The Information You Need to Avoid Default! I wrote this book because this nation has over a trillion dollars in student loan debt. Students are paying or will be paying as graduates, over 6% interest on these loans and the debt is steadily piling up for most people who are pursuing higher education. It's an unfortunate situation but perhaps, an investment in yourself. Jobs are tight and you may or may not be able to find a job in the field in which you studied after you graduate but you will be educated, if you take the matter of your college experience, in the classroom, seriously. So, because some are unable to pay their student loan debt, for various reasons, I wrote books about this to try to provide important and useful information because student loan default is a serious financial problem for many. Why not avoid it, if you can? To acquire my new book, here is the site: http://www.amazon.com/Forgiveness-Your-Student-Loans-Part-ebook/dp/B00HNF3XWC/ref=sr_1_4?s=books&ie=UTF8&qid=1388776071&sr=1-4&keywords=forgiveness+for+your+student+loan

The book is in kindle format so if yo don't have a kindle, you can go to this site and download the free kindle app: http://www.amazon.com/gp/feature.html?docId=1000493771 The app can be downloaded to your smart phone, ipad, iphone, Windows 8 PC or tablet, Blackberry or Windows Phone.

I share this book with you because if you are a student taking out loans or a graduate of a college/university and have loans as a result, the above information may be useful to you. I bring it up in the context of getting our act together, in this new year, in regard to finances and perhaps spending less on our hair, as an immediate step. Personally, I believe it is cheaper to maintain your hair naturally. Literally, all that is needed is to wash your hair and take care of it yourself, which eliminates the cost of anyone else being involved. So what do you need? First let's begin with product. For some individuals, within the context of deciding to go natural, a need seems to arise to spend significant amounts of money on the purchase of hair products. Why? Truly, all that is needed is a good, thick, creamy shampoo and conditioner (if you can get them both in the same bottle, that is particularly great) and a good moisturizer. If you do not have locks, you need a good comb and whether you have locks or not, a good brush. That's truly it! There is not even a need for a blow dryer, which is very damaging to your hair and runs up your electricity bill!

Personally, I have reduced the costs in regard to taking care of my hair so significantly that I am extremely proud about it. There is very little money made by anyone in regard to my hair. All of the money that would be used to line someone's pockets in the billion dollar hair product industry is saved for me. All of that money and time that I would use to go sit in a chair for someone to do to my hair, what I can do for myself, is saved for me. I wash, condition, moisturize, twist and brush my own hair and have been doing so for over 20 years. I did go a little crazy with product when I decided to start my locks 22 years ago, and prior to that I spent lots of money getting my hair braided until I learned how to braid my own hair, including adding extensions and I don't even want to think about how much it was costing me when I was getting a perm. I've never had a weave, so luckily I was saved from that expense and time consuming endeavor while others would have made a lot of money off of me just so I could wear somebody else's hair that grew out of their scalp. As mentioned above, even when I braided my own hair, adding extensions, I lost way too much of my time and money for the purchase of the hair. So, I decided to stop that! Locks require me taking care of my own hair as it grows out of my scalp and it grows very, very long. Why would I need extensions, synthetic or otherwise? These were very personal decisions for me but it was when I came to these conclusions, in terms of my hair, that I realized that I was conscious and awake and this spread rapidly to many aspects of my life, financially and otherwise.

Ultimately, in this New Year, perhaps taking a moment to consider where we are spending money unnecessarily and taking charge of situations that can truly mess us up financially, like student loans, is a great place to start. Natural hair is so absolutely beautiful. There is no doubt about it. Styling it on your own and stepping out looking beautifully natural is a gift that you can give to yourself. All of the money you save can be used to travel or pay for portions of your education, reducing your need for loans or for anything else that you deem worthy of your money that benefits you. I have chosen these two topics, natural hair and student loans to focus on, as money saving/financial management considerations for the new year. I suggest that you start with your hair and work your way down to your feet and look all around you in terms of everything you are experiencing and decide what you may want to reconsider, in terms of how you spend your money, and how you manage your finances. In 2014, perhaps debt no more, is the way to go. If you ARE in debt, how can you acquire the knowledge to make it less stressful and so you can handle it in an empowered manner? The bottom line is that being natural, in terms of your hair, and taking care of that aspect of your life, financially, is a starting point to opening your consciousness about what matters to you. As you look at yourself in the mirror, in the year 2014, will it be better for you financially if you embraced your natural hair and decided Natural IS Cool Enough and took charge of managing your own hair? That would be and is definitely N.I.C.E.!

No comments:

Post a Comment